ETH Price Prediction: Navigating Resistance Toward $5,000 Target

#ETH

- ETH faces technical resistance at $4,486 but maintains strong fundamental support from institutional investment and tokenization developments

- The MACD histogram remains positive at 126.87, indicating underlying buying pressure despite short-term bearish signals

- Korean capital inflows and BETH launch create bullish catalysts that could drive price toward the $5,000 target upon breaking key resistance levels

ETH Price Prediction

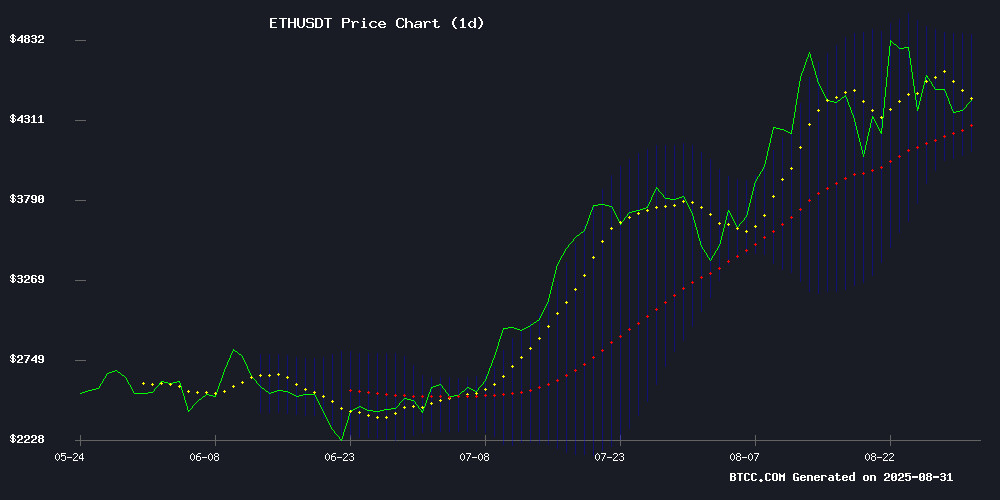

Technical Analysis: ETH Faces Key Resistance at 20-Day Moving Average

ETH is currently trading at $4,434.20, sitting below its 20-day moving average of $4,486.20, indicating near-term bearish pressure. The MACD reading of -12.66 shows weakening momentum, though the positive histogram of 126.87 suggests some buying interest remains. Bollinger Bands position ETH between $4,104.53 and $4,867.87, with the current price hovering NEAR the middle band.

According to BTCC financial analyst James, 'The $4,486 level represents critical resistance. A break above could trigger momentum toward the upper Bollinger Band around $4,868, while failure may test support at $4,105.'

Market Sentiment: Bullish Fundamentals Counter Technical Resistance

Ethereum faces mixed signals as technical resistance contrasts with positive fundamental developments. The launch of BETH tokenization and Korean institutional investment provides underlying strength, while Polymarket's $5,000 prediction reflects retail optimism.

BTCC financial analyst James notes, 'The foundation's transparency initiative with BETH and substantial Asian capital inflows create strong fundamental support. However, traders should monitor the $4,500 resistance level closely as technicals and fundamentals battle for dominance.'

Factors Influencing ETH's Price

Ethereum Faces Near-Term Resistance as Polymarket Traders Bet on $5K Target

Seventy-five percent of Polymarket participants now wager Ethereum will reach $5,000 this year, despite mounting technical headwinds. The second-largest cryptocurrency recently lost its footing below $4,300 after failing to sustain momentum above $4,700, breaching a critical ascending trendline identified by Fundstrat's Tom Lee.

Historical patterns compound the bearish signals—September has delivered median returns of -12.55% for ETH over time. Derivatives markets reflect growing caution, with open interest contracting to $9 billion and negative funding rates indicating short-position dominance. Technical charts now suggest potential support between $4,180 and $3,700.

Meanwhile, Remittix emerges as an outlier, with its PayFi utility driving speculation of a potential surge from $0.10 to $2.75 by 2025. The project's real-world payment infrastructure applications are drawing investor attention beyond mere price speculation.

Korean Investors Pour Billions Into U.S. Crypto Stocks Amid Market Downturn

Korean retail investors are shifting capital from traditional tech stocks to crypto-related equities, injecting over $12 billion into U.S.-listed firms this year alone. Bitmine, Circle Internet Group, and Coinbase have emerged as primary beneficiaries, with August seeing $426 million, $226 million, and $183 million inflows respectively.

The trend marks a stark pivot from previous investments in Tesla and Nvidia. Notably, Korean traders allocated $282 million to a leveraged Ether ETF despite regulatory headwinds in both the U.S. and domestic markets. "Korean investors are reshaping global capital flows in ways Wall Street can no longer ignore," observes market analysts.

Buying momentum persists even as prices decline, with Bitmine maintaining strong demand since its June IPO. The activity underscores Korea's growing influence as a crypto market catalyst, particularly in altcoin and derivatives exposure.

Ethereum Foundation Launches BETH: Tokenizing Burned ETH for Transparency and Profitability

The Ethereum Community Foundation has introduced BETH, a tokenized representation of burned Ether (ETH), marking a significant evolution in Ethereum's economic model. Each BETH token corresponds to ETH permanently removed from circulation through the network's fee-burning mechanism, creating an auditable record of supply reduction.

Joseph Lubin, Ethereum co-founder and ConsenSys CEO, hailed the initiative as transformative. "Tokenizing burned ETH unlocks new economic possibilities," he noted. The move not only enhances transparency for institutional participants but also opens potential markets for trading proof-of-burn assets.

With billions in ETH burned annually, BETH converts what was previously vanished value into a verifiable on-chain asset. The foundation has released contract details and documentation, signaling readiness for ecosystem integration.

How High Will ETH Price Go?

ETH shows potential for upward movement toward $5,000, though immediate resistance at $4,486 must be overcome. Technical indicators suggest consolidation between $4,105-$4,868 in the short term, while fundamental developments provide longer-term bullish catalysts.

| Key Levels | Price (USDT) | Significance |

|---|---|---|

| Current Price | 4,434.20 | Below 20-day MA resistance |

| Immediate Resistance | 4,486.20 | 20-day moving average |

| Upper Target | 4,867.87 | Bollinger Band upper limit |

| Support Level | 4,104.53 | Bollinger Band lower limit |

| Market Prediction | 5,000.00 | Polymarket trader target |